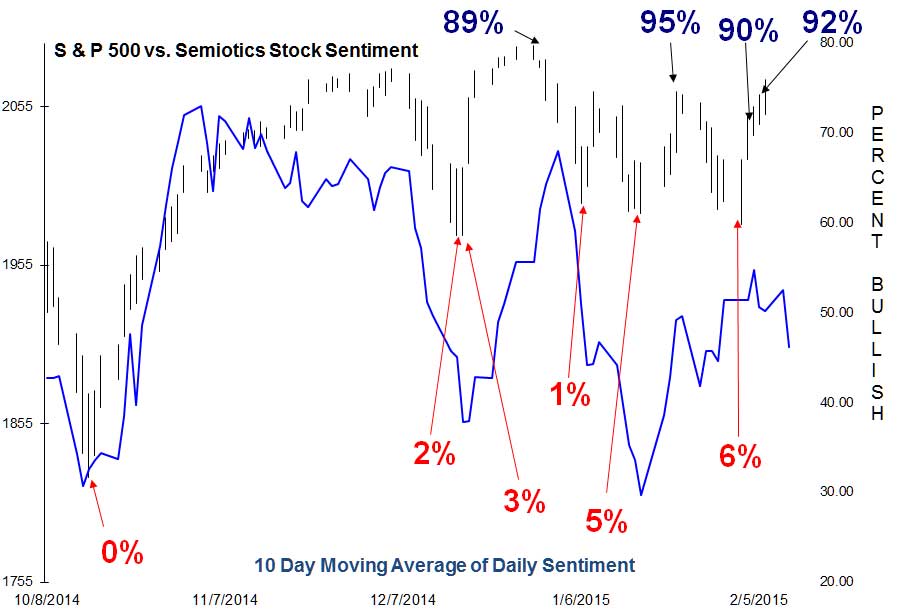

READ ON FOR SOME OF THE PREDICTIONS MADE IN MY SENTIMENT TIMING NEWSLETTER

The 10/15/14 turn date was predicted 3 weeks in advance-SPX Rallied Drops 260 points

09/23/14 Weekly Newsletter

Posted September 23, 2014

GENERAL MARKET COMMENTS: Global Equity Markets were “Stalled” before beginning to unravel. The BABA spike and subsequent Reversal on my Timing Node is a cogent Tell. As I detail below, this could finally become a notable Correction into a, “Black Hole” which may occur in October. It is hard for Investors to recognize how Price, Sentiment and Market Stories interact in the context of a market forecast.

My Sentiment is the best there is but, it always has to be interpreted. The 93% Bullish on the BABA IPO may not look cogent but it is, in the context of the price thrust and the news near that event. One might typically to see overt or very high sentiment like 100% at a Top. Not usually, it is often a more “Reading” of all of the market signs in the three Cognitive spheres of the Brain.

MARKET TIMING FACTORS: Stocks did rally into the predicted Timing node and have turned down. My Timing Profiles are based on 40 years of study. There are aspects of my studies which have never been published. One factor is the potential for what I call “Black Holes.” These re typically short term Negative price Magnets.

There is one due 10/13ish. Thus, stocks may now be beginning to tip down towards that. Since this is also a Seasonally Negative period, probabilities favor an eventual very negative surprise. So let us see how it manifests.

§

The 09/18/14 turn date was predicted weeks in advance-SPX Drops 200 points

09/09/14 Sentiment Timing Weekly Newsletter

Posted September 9, 2014

GENERAL MARKET COMMENTS: Global Equity Markets have stalled even though, “Peace” has broken out!? The Liquidity Gestalt still has a halo and, a following. The 8/25ish node more or less stopped the upside momentum. I noted the lack of profile clarity over the last week or so.

That strangeness is continuing and has produced a sideways market which may continue into the next node of note due late next week. Expected overt Dollar strength accentuated Crude and Oil weakness.

MARKET TIMING FACTORS: Again, very near term timing profiles lacked cogency and the market has in turn been sloppy. The next node of note has always been due near “9/22.” This may manifest as early as 9/18. There is a cluster of date certain events: FOMC: 9/17, Scotland Vote: 9/18, and the Ali Baba IPO: 9/19. More defined negativity has always been due in the first two weeks of October. Thus, the 9/18-22 node looks like it could be a Cognitive Breakdown.